Irs depreciation calculator

Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. The rates will be.

Depreciation Schedule Template For Straight Line And Declining Balance

For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000.

. 3 for overpayments 2 in the case of a corporation. Depreciation limits on business vehicles. In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently updated for the 2022 tax year.

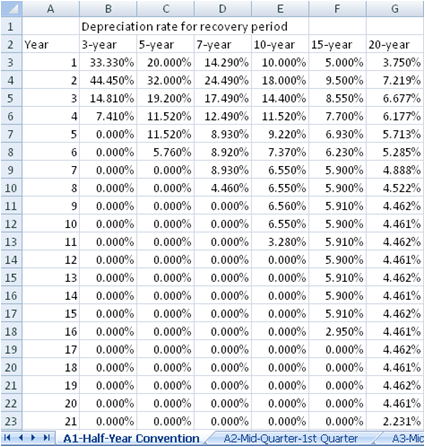

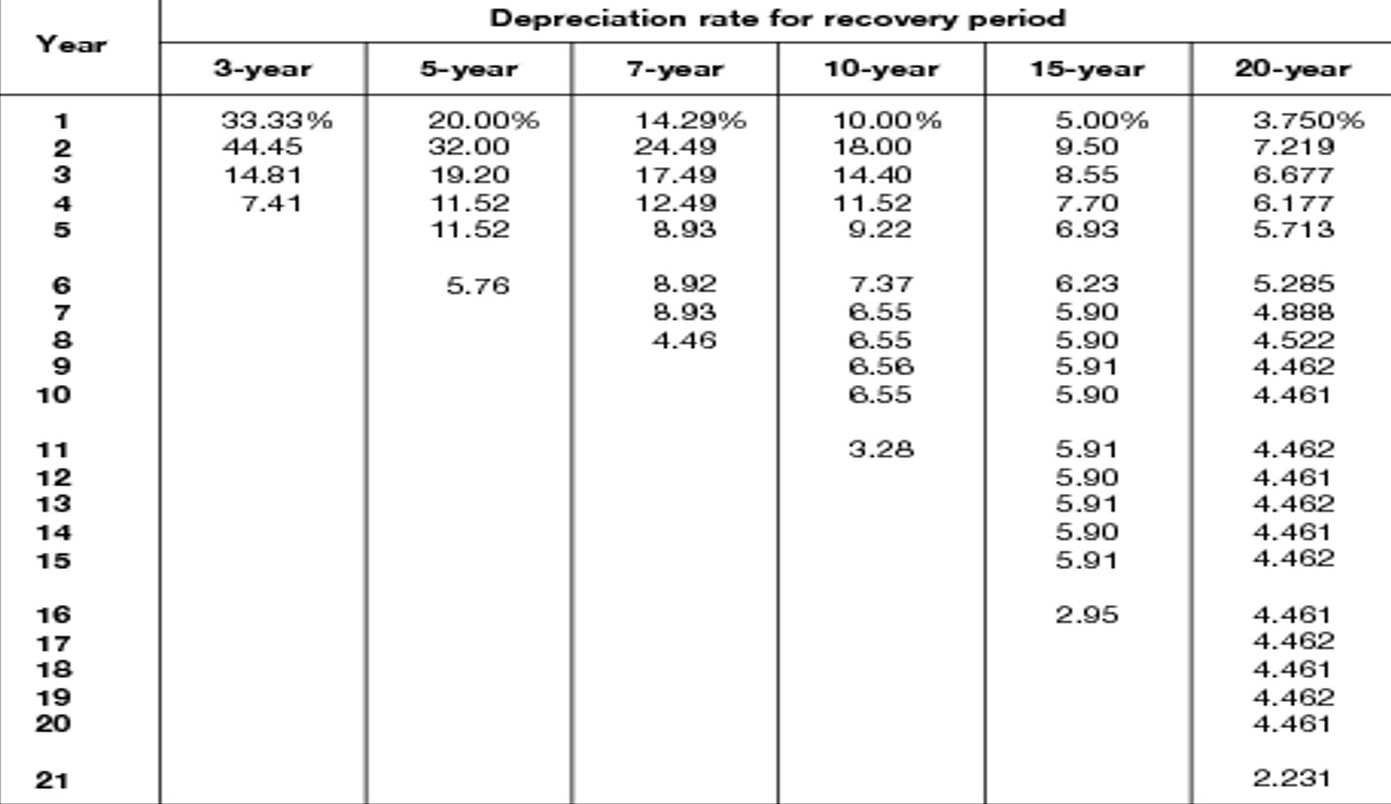

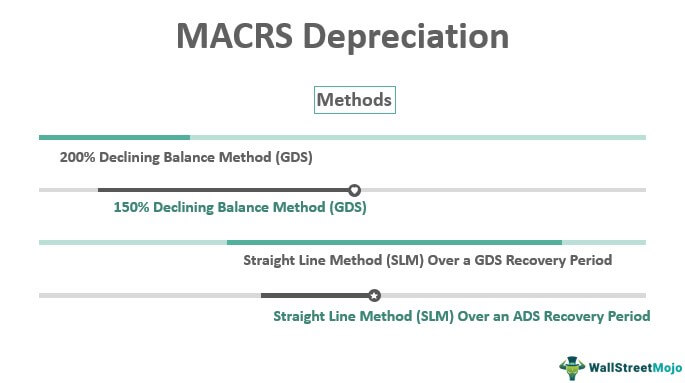

Using the MACRS Tables. Enter an assets cost and life and our free MACRS depreciation calculator will provide the expense for each year of the assets life. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years.

IRS interest rates will remain unchanged for the calendar quarter beginning April 1 2021. It will calculate straight line or declining method depreciation. D j d j C.

The average car depreciation rate is 14. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. 5 for large corporate underpayments.

The IRS refers to the gain that specifically relates to depreciation as unrecaptured section 1250 gain This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was. For example if you purchase a computer for 1500 you generally cant. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page.

For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. MACRS Depreciation Calculator Help. Sum-of-Years Digits Depreciation Calculator.

The Car Depreciation Calculator uses the following formulae. A P 1 - R100 n. Special depreciation allowance or a section 179 deduction claimed on qualified property.

MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available. Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document.

Leveraging Section 179 of the IRS tax code could be the best financial decision you make this year. The IRS considers the useful life of a rental property to be 275 years so the amount of depreciation you can claim each year is your. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply. Section179Org successfully petitioned Congress to raise the Section 179 limit and with your support well ensure it remains strong.

Calculate your potential savings with. The depreciation formula is pretty basic but finding the correct depreciation rate d j is the difficult part because it depends on a number of factors governed. IRS Depreciation Guidelines - This is a helpful article provided by the IRS that answers many questions related to depreciation of.

Rather the IRS allows you to deduct only a portion of the cost each year over the number of years the asset is expected to last. If you didnt deduct enough or deducted too much in any year see Depreciation under Decreases to Basis in Pub. Real Estate Property Depreciation Calculator.

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. Use our 2022 Section 179 calculator to quickly calculate potential depreciation on qualifying business equipment office furniture technology software and other business items. D P - A.

Above is the best source of help for the tax code. Assets are depreciated for their entire life allowing printing of past current and. This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange. Depreciation you deducted or could have deducted on your tax returns under the method of depreciation you chose.

SIGN YOUR APPROVAL FOR SECTION 179 Your voice matters. To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation.

Assume a depreciation rate of 30 after the first year and 20 each consecutive year.

Double Teaming In Excel

Macrs Depreciation Calculator Straight Line Double Declining

Automobile And Taxi Depreciation Calculation Depreciation Guru

Free Modified Accelerated Cost Recovery System Macrs Depreciation

The Mathematics Of Macrs Depreciation

Macrs Depreciation Calculator With Formula Nerd Counter

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Solved Depreciation Rate For Recovery Period Year 3 Year Chegg Com

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Depreciation Macrs Youtube

Guide To The Macrs Depreciation Method Chamber Of Commerce

Free Macrs Depreciation Calculator For Excel

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Modified Accelerated Cost Recovery System Macrs A Guide